UOB to cut maximum interest rate for flagship savings account from May 1

The local bank says the revision of interest rates for its UOB One Account is necessary “to align with long-term interest rate environment expectations”.

SINGAPORE: UOB will lower the interest rates for its flagship savings account from May 1, making it the first local bank to do so as market expectations build up for the possibility of rate cuts by the US Federal Reserve in the coming months.

In a letter addressed to its customers on Monday (Apr 1), the revision of interest rates for its UOB One Account is done “to align with long-term interest rate environment expectations”.

Like the flagship savings accounts offered by DBS and OCBC, UOB’s One account provides tiered interest rates that go up as customers grow their account balance or spend a minimum on select cards and conduct other transactions with the bank such as taking up a mortgage.

In late 2022, the lenders made aggressive hikes to the interest rates on their flagship savings accounts amid a rising rate environment, with UOB offering the highest maximum interest rate of 7.8 per cent.

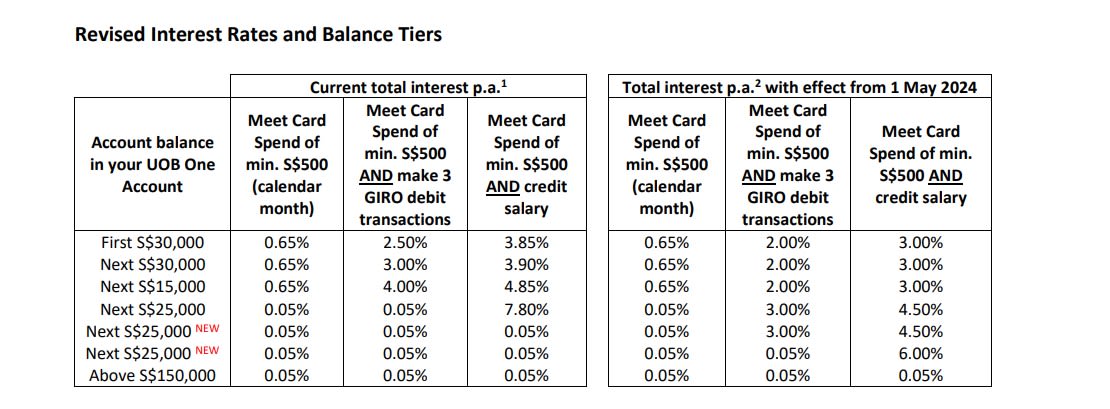

With its latest move, the tiered interest rates for UOB One account holders with balances of up to S$100,000, credit their salary to the bank and meet a minimum spend of S$500 a month on an eligible bank card will range from 3 per cent to 4.5 per cent per annum.

This is down from the current 3.85 per cent to 7.8 per cent.

UOB is also introducing two new tiers, although account holders will need to have account balances above S$100,000 to qualify. They will also have to meet the same salary and spending criteria.

For example, interest earned on balances between S$100,000 to S$125,000 will go up to 4.5 per cent per annum from the current 0.05 per cent.

Savings amounts between the S$125,000 and S$150,000 tier will earn the maximum bonus interest rate of 6 per cent a year, up from the existing 0.05 per cent.

“With these changes, you can now earn up to S$6,000 total interest in a year for deposits of S$150,000 when you spend a minimum of S$500 on eligible UOB Cards and credit your salary via GIRO/PayNow each calendar month,” UOB said.

Currently, OCBC pays a maximum of 7.65 per cent a year for its 360 savings account, while the highest rate on DBS’ Multiplier account stands at 4.1 per cent per annum.

In response to CNA’s query, OCBC did not indicate any changes in interest rates for now, although it said that the bank regularly reviews its product offerings to be aligned with competition and market conditions.

“We will strive to continue to offer our customers products and services that meet their savings and wealth accumulation needs,” said its head of group wealth management Tan Siew Lee.

Likewise, DBS would only say it continues to “prioritise providing the most inclusive and broad-based deposits and savings solutions”, such as its Multiplier account and fixed deposits, amid sticky inflation and an elevated cost of living.

At its last policy meeting, the US central bank left its benchmark overnight interest rate unchanged while holding onto its outlook for three cuts in borrowing costs this year.

Fed chair Jerome Powell has said the timing of the rate cuts still depends on officials becoming more confident that inflation will continue to decline towards the central bank’s target of 2 per cent, even as the economy continues to outperform expectations.

Despite the caution by Fed officials, “markets are still expecting the US central bank to cut rates in June with a 60 per cent probability”, said OCBC’s managing director of investment strategy Vasu Menon.

Market watchers will be keeping a close eye on inflation and household spending data in the coming months.

“There are hopes that consumer spending could weaken in time especially since real disposable income growth declined in February … At the same time, core services inflation is slowing and could continue throughout the year,” Mr Menon wrote in a note on Monday.

“By the time the Fed meets in June, markets are hopeful that economic and inflation data could be convincing enough for them to commence rate cuts,” he added.

Kit, T. S. (2024, April 1). UOB to cut maximum interest rate for flagship savings account from May 1. CNA. https://www.channelnewsasia.com/singapore/uob-cut-maximum-interest-rate-flagship-savings-account-may-1-4234181